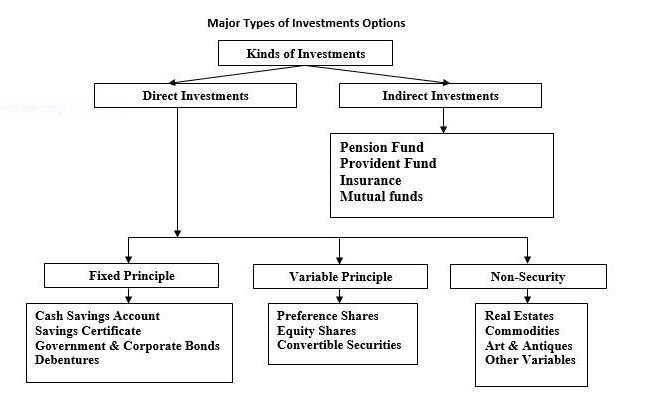

In all these trade-offs, the trade – off is between known amounts that are invested today, in return for an expected amount in future. While the amount being invested is certain, as it is now in our hands of rather is going out of our hands, the expected future inflow carries with it uncertainties regarding its realization. Managing the investment is a dynamic and an ongoing process. This process starts with planned initial investment and the real task is monitoring and updating the investments in the wake of new developments. Numerous avenues of investment are available today. One can either deposit money in a bank account or purchase a long – term government bond or invest in the equity shares of a company or contribute to a provident fund account o r buy a stock opt ion or acquire a plot of land or invest in some other form. Almost everyone owns a portfolio of investments. The portfolio is likely to comprise financial assets (bank deposits, bonds, stocks, and so on) and real assets (motorcycle, house, and so on). The portfolio may be the result of a series of haphazard decisions or may be the result of deliberate and careful planning.

Diversifying is that reduce the risk that local financial markets will suffer an extended bear market. While global investing includes some additional risks, such as currency fluctuations and political uncertainty, diversifying globally can help offset overall portfolio volatility. Numerous avenues of investment are available today. Investors can select the suitable avenue according to their desired level of risk, return and liquidity. The portfolio may be the result of a series of haphazard decisions or may be the result of deliberate and careful planning. Financial investments are the backbone of an economic system and aid collection of scarce capital across the productive sectors of the economy.

Formation of Diversified Investment Portfolio

It is the next step in investment management process. Investment portfolio is the set of investment vehicles, formed by the investor seeking to realize its’ defined investment objectives. In the stage of portfolio formation the issues of selectivity, timing and diversification need to be addressed by the investor. Selectivity refers to micro forecasting and focuses on forecasting price movements of individual assets. Timing involves macro forecasting of price movements of particular type of financial asset relative to fixed-income securities in general. Diversification involves forming the investor’s portfolio for decreasing or limiting risk of investment. The two techniques of diversification-

1. Random diversification, when several available financial assets are put to the portfolio at random

2. Objective diversification when financial assets are selected to the portfolio following investment objectives and using appropriate techniques for analysis and evaluation of each financial asset.

Important Benefits of Diversification in Investment

Two well-known theories in the finance literature, the Capital Asset Pricing Model – CAPM and the Modern Portfolio Theory-MPT, suggest that individual and institutional investors should hold a well-diversified portfolio to reduce risk. An institutional investor can achieve a well-diversified portfolio because the amount of funds in the portfolio is large enough for in-house diversification. Individual investors with limited wealth will have to find another way that does not require substantial funds to diversify their portfolios.

1. Planning an asset allocation

2. Diversification enables rebalancing

3. Diversification corrects for human bias

4. Risk Reduction

5. Limiting Losses

6. Improved Returns

7. Greater Flexibility

8. Retirement Planning

9. Asset allocation strategies to mitigate systematic risk

10. Owning a variety of industries and stocks to mitigate unsystematic risk

Diversification of Investments Portfolio

In a globalized scenario, economic activity has been characterized by a spectacular increase in the international dimensions of business manoeuvre. The rapid intensification of international trade accelerated the globalization of financial activity which brought diversified investment opportunities that are no longer restricted to domestic markets, but financial capital can now seek opportunities abroad with relative ease. In view of this, the current paper tries to overview the scope of international portfolio investment in the globalized world. Investing internationally provides not only increased stability to a portfolio but also potential higher yields with less risk. Therefore, investors should diversify portfolio globally because it will offer improved stability of their financial profile as well as higher yields with less risk.

Diversification is a familiar term to most investors. In the most general sense, it can be summed up with this phrase: “Don’t put all of your eggs in one basket.” Growing volume of cross-border transactions has integrated national economies of different countries bringing them close to each other. The higher degree of market integration has become possible due to reduced regulatory barriers among countries, lower cost of communications etc. This has been apparently reflected through the worldwide growth of exports and imports as a proportion of GDP of individual countries that have resultantly internationalized consumption patterns in different ways. It is a passive investment in securities, none which entails in active management or control of the securities’ issued by the investor. Portfolio investment is an investment made by an investor is not particularly interested in involvement in the management of a company.

Investment Opportunity –RRT (Risk, Return and Time Period)

Financial investments comprise capital market instruments and other assets like bank deposits, mutual fund, insurance, chit fund, derivatives, real estate, foreign currency, gold, commodities, provident funds, post office savings schemes, government securities, tax-free bonds, shares and securities and others like public sector bonds, etc. Investors want to minimize the risk associated with a given expected return. Diversification can play a role by minimizing firm-specific risks that add to the overall uncertainty of returns.

Risk – Investment risk is related to the probability of actually earning less than the expected return; thus, the greater the chance of low or negative returns, the riskier the investment. Most portfolios are diversified to protect against the risk of single securities or class of securities. Hence, portfolio analysis consists of analyzing the portfolio as a whole rather than relying exclusively on security analysis, which is the analysis of specific types of securities. To assemble an efficient portfolio, one needs to know how to calculate the returns and risks of a portfolio, and how to minimize risks through diversification.

Return – Each expected return value in the portfolio expected return is weighted according to what percentage that asset takes up in the portfolio. It is the monetary return experienced by a holder of a portfolio. Portfolio returns can be calculated on a daily or long-term basis to serve as a method of assessing a particular investment strategy. Dividends and capital appreciation are the main components of portfolio returns. Rate of return calculations falls into two general categories: time-weighted and money-weighted. The key point to understand, therefore, is that any differences in reported returns come about as a result of cash inflows and outflows.

Time period – It refers to the period of time required to recoup the funds expended in an investment. Rate of return is a profit on an investment over a period of time, expressed as a proportion of the original investment. The time period is typically a year, in which case the rate of return is referred to as an annual return. Investments with shorter payback periods are considered to have a lower risk than those with longer payback periods. ROI is a popular financial metric for evaluating the financial consequences of individual investments and actions.

Conclusion

All investments involve some degree of risk. The reward for taking on more risk is the potential for achieving a greater return. In general, financial instruments like bank deposit, mutual fund, insurance, chit fund, derivatives, real estate, foreign currency, gold, commodities, public provident fund, tax free bonds, shares and securities have the greatest risk and highest potential returns among major asset classifications. Diversification factors are a widely embraced investment strategy that helps mitigate the unpredictability of markets for investors. It has the key benefits of reducing portfolio loss and volatility and is especially important during times of increased uncertainty. Even when diversifying domestically significant benefits can be achieved. However to maximize diversification benefits investors should strive for a global exposure to broad asset classes. Diversification will not guarantee a profit or assure against losses during bear markets; however it should at the very least provide considerable protection of some of the gains investors have thus far accumulated. In the recent investment scenario risk management practices are gaining much impact and hence understanding the investment behavior becomes more crucial.

References

1. Anil M. Pandya and Narendar V. Rao, “Diversification and firm performance: An empirical evaluation” Journal of Financial and Strategic Decisions, Vol 11, No.-2, p-67, 1998.

2. Xian and Zhongfeng, “An expected regret minimization portfolio selection model”, European Journal of Operational Research. Apr2012, Vol. 218 Issue 2, p484-492

3. Jaksic, Milena and Miljan, “Investment risk management by applying contemporary modern portfolio theory”, Megatrend Review. 2015, Vol. 12 Issue 1, p31-46

4. Olaleye, Abel, Aluko, Bioye.T Oloyede and Samuel.A, “Evaluating diversification strategies for direct property investment portfolios”, Journal of Real Estate Portfolio Management. Jul-Sep2008, Vol. 14 Issue 3, p223-231

5. Shanmugham.R, “Factors Influencing Investment Decisions”, Indian Capital Markets –Trends and Dimensions (ed.), Tata McGraw-Hill Publishing Company Limited, New Delhi, 2000.

Website references

1. www.oecd.org/sti/outlook/eoutlook/stipolicyprofiles/competencestoinnovate/financingbusinessrdandinnovation.htm

2. http://business.mapsofindia.com/investment-industry/top-10-investment-options.html

3. http://thismatter.com/money/investments/portfolios.htm

Dr. Senthil Kumar, is an Associate Professor of Finance and Business Management in Skyline University Nigeria. He has a PhD. in Business Management from Bharathiar University, India.

You can join the conversation on Facebook @SkylineUniversityNG and on Twitter @SkylineUNigeria